2024 was not a favorable year for renewable energies on the heating market in Germany either. The uncertainty among consumers caused by the Building Energy Act (GEG), which became known as the "heating hammer", remains. In comparison to 2023, sales of pellet stoves (wood-burning stoves and heaters) once again declined sharply by 45% to 30,650 installations.

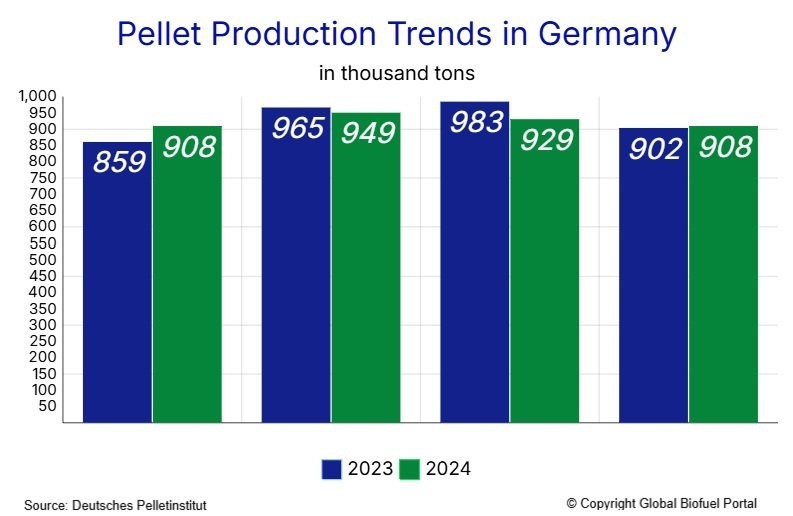

German pellet production holds a leading international position: at 3.695 million tons, domestic production in 2024 was still clearly ahead in Europe. Germany is expected to maintain its top position in the market. However, due to the anticipated weak growth in the heating systems sector, there are no signs of a major increase for this year, despite the slump in 2024. Therefore, a significant upturn is not anticipated.

There are sufficient domestic wood pellets available, even if the sales of pellet heating systems were to increase significantly. The sawmills located throughout Germany either process their residual wood materials (such as chips and shavings) directly on-site into wood pellets accounting for approximately 60 percent of total pellet production or supply these byproducts to specialized pellet manufacturing facilities.

While the domestic pellet stove market in Germany is experiencing a downturn, the demand for wood pellets in the UK is gaining momentum. A record of 9.641 million metric tons in 2024 for UK imports shows a sharp increase due to the industrial sector, which accounts for 93% of the country's total pellet consumption. The latest figures contrast a significant rise from 6.364 million tons in 2023 and 7.516 million in 2022. As the analysts of Global Biofuel Portal point out, this trend features the UK’s growing role in the global pellet market, making the country one of the world's leading consumers of wood pellets https://pellets-wood.com/news-uk-enters-new-era-of-pellet-import-as-targets-set-at-9-641-million-metric-tons-12.html. This highlights Germany’s stable supply and export strength in contrast to rising global demand, particularly from the UK, reinforcing its leadership in the European pellet market.

German wood pellet production decreased slightly in 2024 in comparison to the record output achieved in 2023, with a decrease of roughly 15,000 tons. This suggests that only about half of the residual wood generated from cutting operations in Germany was being used for pellet production.

DEPV Managing Director Martin Bentele notes that this important regional resource cannot realize its full potential for domestic economic contribution due to the sluggish energy transition. The German Energy Wood and Pellet Association (DEPV) https://www.depv.de expects pellet production to increase only slightly to 3.8 million tons in 2025. Although pellet trade takes place with neighboring countries such as Austria, Switzerland, Poland, or France, Germany remains self-sufficient and a net exporter of wood pellets.

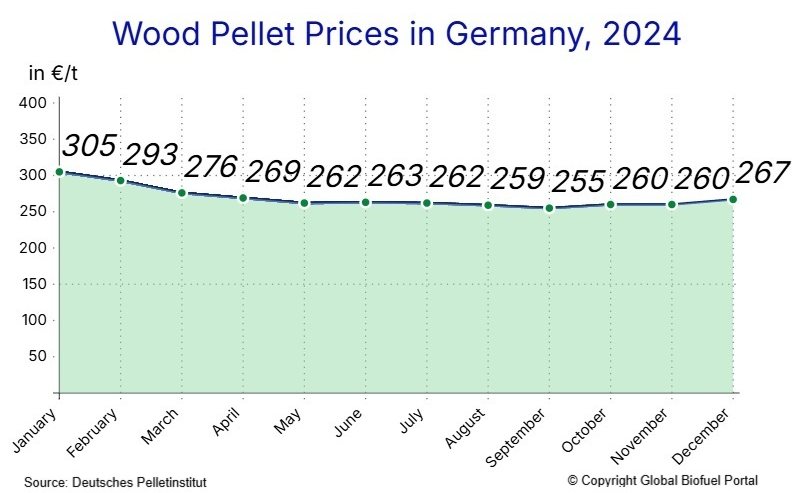

Almost all production in 2024 was quality-tested in accordance with the ENplus certification system and therefore suitable for use in domestic systems. Around 80 percent of the trade volume is now certified. Pellets also score points from a social point of view and continue to be the cheapest energy source for residential buildings. It lacks transitioning. Their price fell significantly in 2024: while the average price in 2023 was still at 390 euros/t as a result of the energy crisis, it was more than 100 euros lower the following year at 289 euros/t.

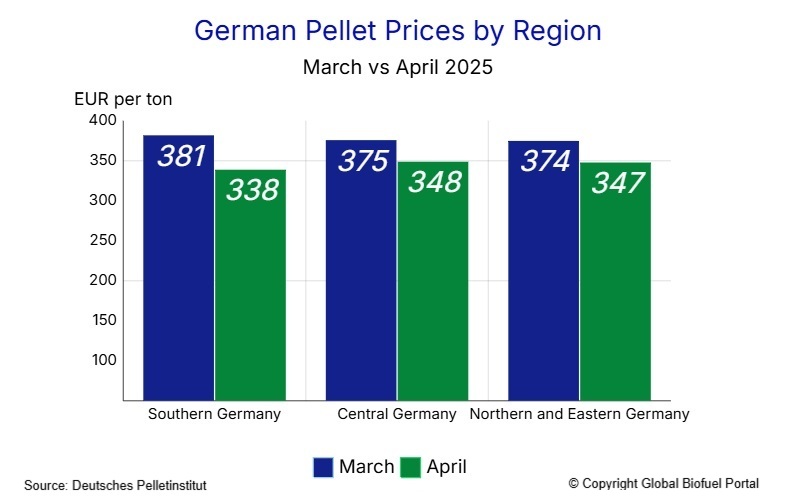

Pellet prices in Germany continue to show regional variation. In March 2025, for a bulk purchase of six tons, prices were as follows:

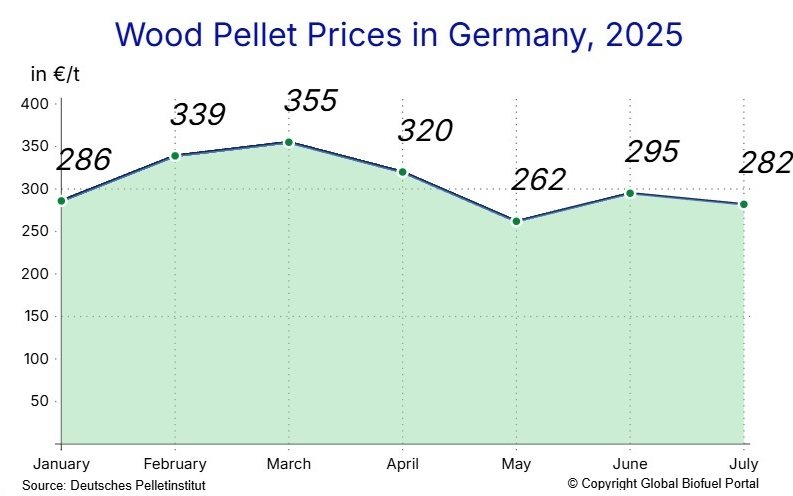

In addition to regional differences, monthly DEPV index data shows a clear upward trend in early 2025 compared to the previous year. For example, the average gross price per ton in March 2025 was:

January and February 2025 also recorded notable increases, with prices reaching:

The prices are calculated based on a typical bulk purchase of six tons of loose-delivered pellets within a 50-kilometer radius. This figure includes all applicable taxes and delivery charges. The pellets themselves meet the highest quality standards, certified under ENplus A1 or DINplus A1.

By April 2025, the prices had shifted noticeably:

The average price for wood pellets across Germany in April 2025 was €343.14 per ton (based on a purchase of six tons), equivalent to roughly 34.31 cents per kilogram. That’s a significant drop compared to the beginning of the year. The price reached €363.21 per ton in February, but in March it was even higher at €380.20, putting significant pressure on heating budgets.

In May 2024, pellet prices reached €280.69 per ton, indicating that despite recent declines consumers are still paying more than they did the year before. The market has been volatile this year - homeowners have really felt these price swings when planning their heating budgets.

In terms of energy cost, this translates to 6.86 euro cents per kilowatt-hour of heat representing a 9.8% drop compared to previous months. When compared with heating oil, pellets currently offer a clear economic advantage, with savings of around 23%.

A little growth is expected in the wood pellet market in 2025. The sharp drop in sales of pellet furnaces last year has left a mark, and the confidence remains low. Still, a moderate recovery could be possible, but only if policy conditions become more stable. Whether the market picks up pace again will depend on whether that stability is achieved. For now, the expectations remain cautious.

In an optimistic scenario, the sales of around 37,000 pellet heating systems are expected in 2025, including 17,000 air-guided pellet stoves, 19,200 pellet boilers up to 50 kW, and water-guided pellet stoves, plus 800 larger pellet systems and combined heat and power plants. This would bring Germany's total pellet installations to approximately 760,000 units by year-end.

This reduces the gap between production and consumption to just 5%, down from 7% last year. Whether the market picks up pace again depends on whether that stability is achieved. For now, the expectations remain cautious, as experts note that the public debate oversimplifies the energy transition by focusing primarily on heat pumps while overlooking Germany's diverse building stock.