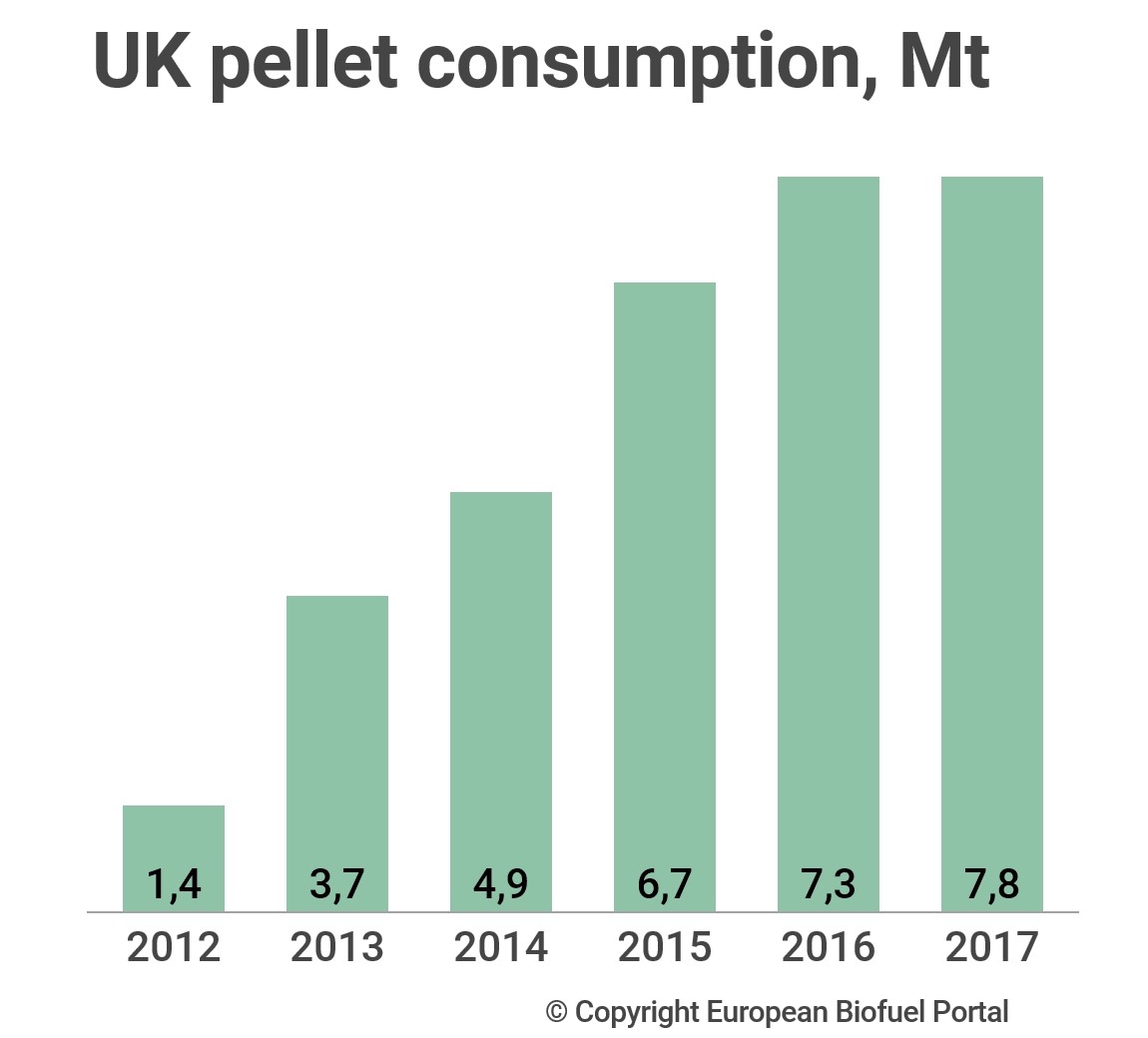

The UK is the leading consumer of pellet products. The consumption level of pellets in the UK significantly exceeds this index for other countries. There are supplies from Canada and the USA. 70% of exported pellets from Canada get into the United Kingdom’s thermal power stations. By the end of 2016 the import of pellets to the UK amounted more than 7.1 million tons.

In the UK, Belgium and the Netherlands, the use of pellets for the needs of population is insignificant. Pellet demand is formed mainly by large power stations. Such large-scale consumption of wood pellets at power stations is due to the EU requirements for the use of renewable energy sources by 2020.

For the first time for the past 10 years, Britain has reduced the import of wood pellets. The decline was 3% for the year and it happened in 2017. At the same time, 2/3 accounted for a decrease in imports to the UK from the United States (1.9%).

The decline of 3% in imports is insignificant and connected with planned stops of a number of energy facilities.

We note that there is no intense competition in the pellet market today. Europe can consume ten times more than what is supplied today, as all coal-fired power plants, which there are still very many, willing to convert to pellets. The reduction in exports from the United States to the UK, which is their main pellet sales market, is most likely related to the reconstruction of a number of power plants that, as a rule, have their pellet capacity in the United States. In addition, the US is actively developing its own pellet market - about 25% of the pellets produced are sold domestically. And if the European market for American granules closes, that could happen in 2020.

Because of the United States didn’t sign the Paris agreement on climate, they will use pellets at home.

The Import of wood pellets within the European Union amounted to 4.861 million tons in the first 9 months of 2017. The largest shipments of granules came from Estonia to Denmark and from Latvia to Great Britain and Denmark.

Among the number of reasons behind the backlog, the challenges associated with logistics are highlighted, namely long distances and high transportation costs, as well as low availability and high cost of financing (for example, updating production lines in order to fit increasingly stringent requirements for product quality).

The largest consumer of wood pellets https://pellets-wood.com/wood-pellets-b327.html in the world is Great Britain (6.7 million tons), followed by the United States (2.8) and Italy (2.1 million tons).

Figure 1. Dynamics of UK pellet consumption

In the UK, two objects transferred to burning industrial pellets - the Lynemouth power station with an installed capacity of 420 MW and TPS Teesside in Middlesbrough - are currently either in the commissioning phase or in the construction phase.

Pic1. Lynemouth Power Station, generating capacity of only 420 megawatts (MW)

Owners of the Drax power station have also recently announced plans to rebuild the fourth power unit to operate on fuel pellets. It is not yet clear how many hours a year this facility will work. However, given the fact that the investment decision was made, according to some approximate estimations, it will consume about 900,000 tons of wood pellets https://pellets-wood.com/sell-b357_0.html a year.

Pic2. Drax power generates 6% of the UK’s electricity and 11% of its total renewable electricity