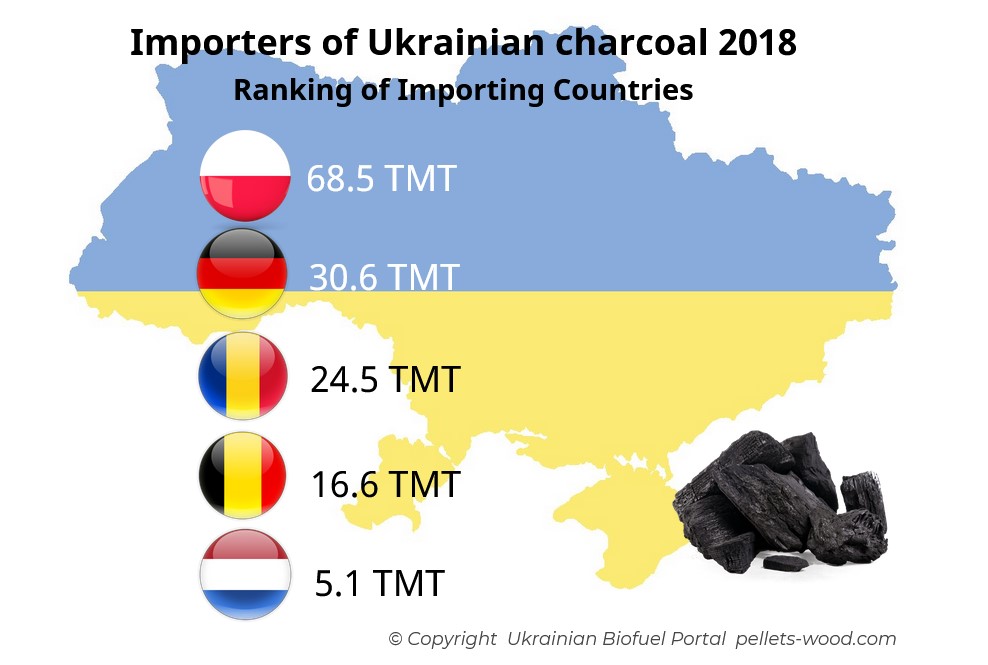

Charcoal of Ukrainian production is in demand both on the domestic and foreign markets. The charcoal demand on the foreign market is indicated by the figures of the increased Ukrainian charcoal export in recent years. The top five buyers of Ukrainian charcoal in 2018 include Poland, Germany, Romania, Belgium, and the Netherlands.

Charcoal is used in different areas:

According to the Database of European Charcoal Buyers in Ukraine prepared by analysts of Ukrainian biofuel portal pellets-wood.com, in 2018 charcoal was supplied to more than 40 countries of the world. The total volume was about 174.032 MT. This figure corresponds to the 2017 level; however, it is almost 7 % more in comparison with 2015 data. Nigeria is one of the main Ukrainian charcoal supply competitors in the world, and particularly in Europe, which exported about 196 thousand tons in 2016.

The stats on European charcoal producers shows that the European market segment is about 561.4 thousand tons annually. It follows that the Ukrainian production share is about 30.9%.

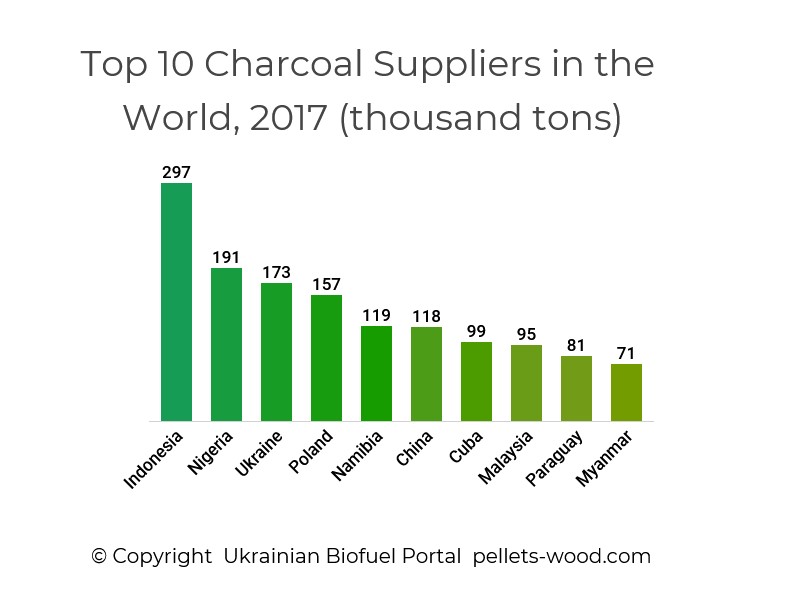

The histogram presents the charcoal exporters ranking. According to 2017 data, Ukraine was the third largest charcoal exporter in the world, supplying about 174 thousand tons to the foreign market.

Histogram 1.1 Top 10 charcoal suppliers in the world, 2017

Ukrainian charcoal producers are export-oriented due to the geographical position of Ukraine. The proximity to the borders of the EU member states (Poland) provides favorable transportation conditions to the European market, and Ukraine’s access to the sea as well as ports of international importance make Ukrainian charcoal attractive to the countries in the Middle East. The transportation costs, which are included in the charcoal price, are relatively low compared to major competitors. The largest charcoal producers in the world are African countries (Nigeria, Namibia, Tanzania, Ethiopia, Ghana), India, Brazil, Thailand, etc.

The researchers at Utrecht University predict the growth of the Europe charcoal market in the coming years. At the moment, the main charcoal sales markets in the European Union are Germany, France, the United Kingdom and Poland (mainly serves as a distributor of Ukrainian charcoal in Europe).

According to the Database of European Charcoal Importing Companies https://pellets-wood.com/base-database-of-european-importers-and-buyers-of-char-11.html prepared by Ukrainian biofuel portal in 2018, charcoal purchases in Ukraine were made by 376 companies of the EU and the Middle East. Poland and Germany with the imports volume 68.5 thousand tons and 30.6 thousand tons respectively in 2018 take the leading positions for several years straight. Romania is rated lower with 24.5 thousand tons, followed by Belgium with 16.6 thousand tons. The top five is closed by the Netherlands with the import volume 5.1 thousand tons.

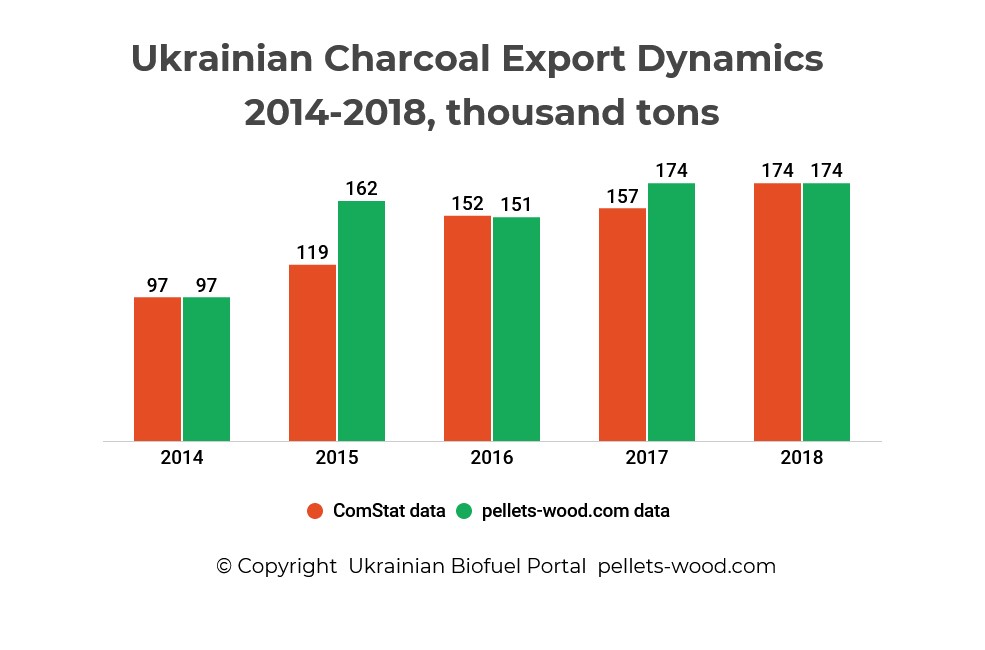

Ukraine is a major charcoal exporter in the world. In 2015, Ukraine exported 162.2 thousand tons. The peak of charcoal demand was in the first and second quarters; in summer and autumn, there was a seasonal decline.

In 2016, a significant decrease in demand for Ukrainian charcoal was recorded. The total exports amounted to 151.9 tons. The experts attributed the fall in charcoal demand to the mild and warm winter in Europe, which affected the purchase volumes.

In turn, in 2017, the volume of the exported product increased by 14% compared to the previous year and amounted to 174.18 thousand tons. The 2018 figures remain at the previous year’s level.

Histogram 1.2 shows the dynamics of charcoal exports from Ukraine in 2014-2018. The stable export growth has been fixed since 2015, and the database has been replenished with new importing countries of Ukrainian charcoal.

Besides, in Poland, for example, - one of the largest Ukrainian charcoal importers and distributors, a number of charcoal briquette factories have recently started their work. They are looking for raw materials such as cheap charcoal, screenings, and dust. This also explains an increase in demand.

The growth in demand for Ukrainian charcoal can be illustrated by the database of importers increasing. The database 2013 has 263 importing companies, the database of importers 2018 already comprises 376 countries including the countries of the Middle East (Israel, Iran, Iraq, Jordan, etc.), where charcoal is their traditional fuel type.

Histogram 1.1 Ukrainian charcoal export dynamics 2014-2018

In the domestic market, charcoal is mainly used for domestic purposes: as fireplace fuel, ignition, and fuel for a barbecue, which implies the seasonal increase in demand. Accordingly, the demand increases in the period of April to July, then there is a recession, and the second peak in demand is October-December.

Today, charcoal is practically not used in Ukraine for industrial purposes due to the downturn in the metallurgical industry in recent years. The main consumers are catering, retail charcoal trade enterprises, and trade networks; slightly less - the agricultural sector (fertilizers and animal husbandry).

Charcoal production for export can be the main direction for Ukrainian producers who want to increase sales. Opportunities in the global market are open for Ukrainian manufacturers while ensuring the proper quality of charcoal meeting international standards and competitive prices (due to favorable logistics).

Charcoal production is a fairly profitable business, as the market is actively developing and growing. The share of Ukrainian goods on the European market - 1/3 of the total imports volume - is impressive; however, there are the prospects for export growth. It is replacement of Nigeria, Namibia and other competing countries’ volumes, struggle for the Middle East market with traditionally high charcoal demand. Good quality and competitive price are required for this. Speaking of the quality and price, it means government support aimed at tax reduction in the field and creating favorable conditions to bring the business out of the shadows. Official and profitable activity will reduce the number of handicraft productions, improve product quality, and provide an opportunity to increase the number of exported products.

Doing legal charcoal business can increase export turnover. Charcoal producers of Ukraine and African countries often use low-quality or illegal wood for charcoal manufacturing. It provokes massive deforestation, affects the quality of finished charcoal, and may discredit brand in the foreign market. The charcoal quality is an important parameter for export-oriented products. In particular, European importers have high quality requirements to moisture level, ash and carbon content, volatile matter release. It is often necessary to have a quality certificate or test report confirming the compliance with seller’s specifications as well as a certificate to confirm the timber legality.